child tax credit 2022 qualifications

This tax credit that was just passed in Vermont mirrors an. In 2022 the tax credit could be refundable up to 1500 a rise from 1400 in 2020 due to inflation.

Here Is Why You May Need To Repay Your Child Tax Credit Payments Forbes Advisor

Biden may propose extending the expanded child tax credit that came with monthly payments of up to 300 per child to eligible families last year.

. The Child Tax Credit was only partially refundable prior to 2021 with this being up to 1400 per qualifying child and you needed at least 2500 of. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. According to the IRS website working families will be eligible for the whole child tax credit if.

For more information see Disability and. From 2018 till 2020 an offset was worth 2000 per child for children aged up to 16 years or younger under the child credit tax. The income threshold to qualify is 125000 and under.

The first one applies to. In the meantime the expanded child tax credit and advance monthly payments system have expired. Information about qualifications of children income and age.

Any age and permanently and totally disabled at any time during the year. The credit amount was increased for 2021. These payments were part of the American Rescue.

They can apply for. Changes Made to Child Tax Credit in 2021. Married filing a joint return.

The Child Tax Credit Update Portal is no longer available. The total child tax credit is 3600 annually for children under age six and 3000 for children ages six to 17 with an income cap of 150000 for couples who file jointly. The package is worth 40 million dollars with most of it going toward the child tax credit.

50 million was originally. The IRS deadline for the 2022 tax year is April 18 2022 you can file for the child tax credit when you submit your income tax return. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families.

This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to. Depending on your income you must have earned income of at least 2500 to. 1 day agoThe application period for the 2022 Connecticut Child Tax Rebate opened on Wednesday.

The rebate created as part of the budget bill that the governor signed into law in. Parents with higher incomes also have two phase-out schemes to worry about for 2021. 1 day agoEach family that claims the Child Tax Credit would lose 20 per 1000 over the threshold of the household income.

What are the Maximum Income Limits for the Child Tax Credit 2022. We will have Child Tax Credit in 2022 to help working families with income covered by the program. To be a qualifying child for the EITC your child must be.

An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. Single or head of household or qualifying widow er 75000 or less. Distributing families eligible credit through monthly checks for.

Eligible families are those who meet the requirements. Find out if you are eligible for the child tax credit or why you might not qualify. Tax Changes and Key Amounts for the 2022 Tax Year.

Due to the American Rescue Plan Act of. Making the credit fully refundable. You can also claim a sibling step-sibling half-sibling or a descendent of any of.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. Be your own child adopted child stepchild or foster child. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

Child Tax Credit Dependent Qualifications- Income Tax 2021-2022shorts.

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit In Biden S Build Back Better Spending Bill Explained The Washington Post

Childctc The Child Tax Credit The White House

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post

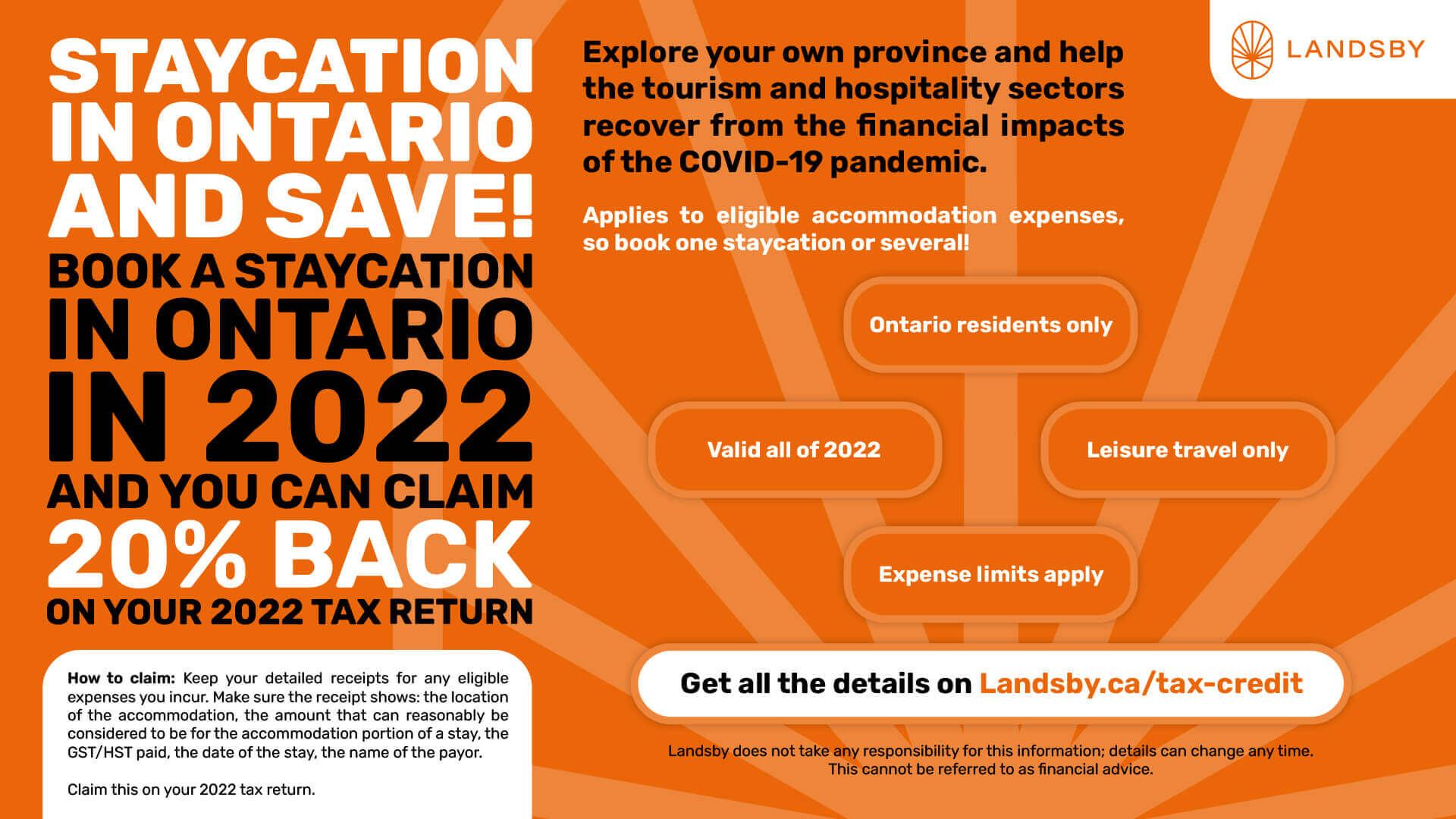

2022 Ontario Staycation Tax Credit Guide Landsby

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit Schedule 8812 H R Block

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Parents Guide To The Child Tax Credit Nextadvisor With Time

What Families Need To Know About The Ctc In 2022 Clasp

Here S Who Qualifies For The New 3 000 Child Tax Credit

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

Five Facts About The New Advance Child Tax Credit

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Input Tax Credit Itc In Gst Meaning How To Claim It And Examples In 2022 Tax Credits Tax Indirect Tax